You Want Option Trades? Get A New One Everyday!

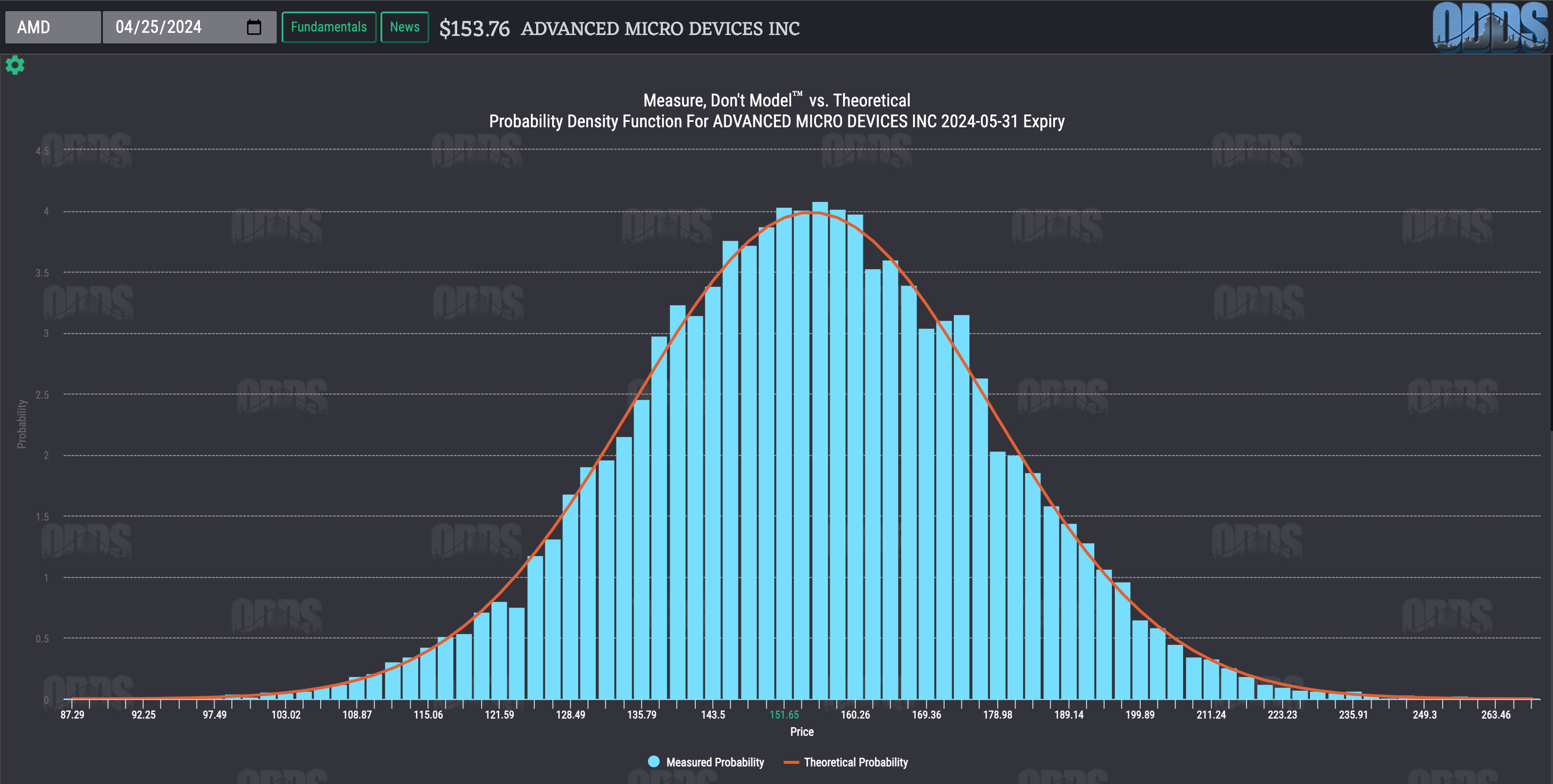

The trend in the market this week has been for large tech stocks like META, GOOG, MSFT, and INTC to have an earnings surprise. We have an option strategy and a plan if the trend continues. Advanced Micro Devices, Inc. (AMD) will announce earnings next week.

Read the FREE ODDS Online Daily Trending Stock Report by clicking the link below the image on the right. You'll get more information on the graph in the image and you'll learn more about why we're interested in a potential AMD earnings surprise.

If you sign up for the ODDS Online Daily service today, you'll get the specifics of our limited risk trade idea to exploit the potential AMD surprise. Plus you'll get a new trade idea everyday the market is open.

Advanced Micro Devices, Inc.

(AMD)

Screenshot

Success Stories

Watch Success Stories

Success Stories

"I made money on all of those trades."

"Of the 31 trades I did from between last July when I started and this February, all but one were successful. In other words, I made money on all of those trades, which of course made me very pleased."

Learn how to trade options they way Randall did, from people you can trust. Learn More.

Read Success Stories

"Your ODDS software is the best thing that has ever happened to me."

"A little update as to my trading the last nine months. Starting in Jan. through Sept. I have placed one trade (BPS) per month. With only one trade that was a loss. The balance of the trades (10) this year have been profitable trades. I have been trading only one ETF every month. Now in the future I think I am ready to trade possibly 2 a month. I have been using the ODDS software exclusively, with each trade listed with 85% plus possibility of success. The ODDS software is the best thing that has ever happened to me. This is the first year that I have really enjoyed trading and being successful to boot! Many thanks."

Let ODDS Online help your trading too. Learn more about it HERE.

"Trade like a hobby, your gain will be as if it were a hobby."

"It's like anything else, you trade like a hobby, your gain will be as if it were a hobby. You treat it like a business, I think you can definitely get a good business income out of it."

Learn to trade the right way with Options Trading As A Business.

"Over $100,000. So he's doing fine."

"One of my friends trained with Don, and last I heard he was up over $100,000. So he's doing fine."

Learn and earn by using ODDS Online for your trading.

"I'm up over $10,000."

"I'm up over $10,000! Don is consistent, repeatable, profitable, safe, and no hype!"

Learn how to do the same type of trades that Roger did through our educational materials. Click HERE

ODDS Research And Trading

ODDS Research And Trading

ODDS Research And Trading

Our company was founded in 1993 on the principle that probability was the key to understanding how options work. Since then, I’ve been widely recognized in the financial press as one of the leading authorities on the subject - so much so that even the prestigious New England Journal of Medicine cited my work and how it could be applied to medicine.

Our mission remains unchanged from the day of our founding - help investors turn the tables by putting the odds in their favor. From education that starts at the beginning, to leading edge software that gives traders a proven advantage, we are your one source for the best in options analysis.

Best of all, we take everything we’ve learned over the past several decades and make things simple. Because our goal has always been to Make Options Easy.

So whether you’re a brand new beginner, or a seasoned veteran...

Trade the ODDS. Make the Money.

Our company was founded in 1993 on the principle that probability was the key to understanding how options work. Since then, I’ve been widely recognized in the financial press as one of the leading authorities on the subject - so much so that even the prestigious New England Journal of Medicine cited my work and how it could be applied to medicine.

Our mission remains unchanged from the day of our founding - help investors turn the tables by putting the odds in their favor. From education that starts at the beginning, to leading edge software that gives traders a proven advantage, we are your one source for the best in options analysis.

Best of all, we take everything we’ve learned over the past several decades and make things simple. Because our goal has always been to Make Options Easy.

So whether you’re a brand new beginner, or a seasoned veteran...

Trade the ODDS. Make the Money.

Our company was founded in 1993 on the principle that probability was the key to understanding how options work. Since then, I’ve been widely recognized in the financial press as one of the leading authorities on the subject - so much so that even the prestigious New England Journal of Medicine cited my work and how it could be applied to medicine.

Our mission remains unchanged from the day of our founding - help investors turn the tables by putting the odds in their favor. From education that starts at the beginning, to leading edge software that gives traders a proven advantage, we are your one source for the best in options analysis.

Best of all, we take everything we’ve learned over the past several decades and make things simple. Because our goal has always been to Make Options Easy.

So whether you’re a brand new beginner, or a seasoned veteran...

Trade the ODDS. Make the Money.

Our company was founded in 1993 on the principle that probability was the key to understanding how options work. Since then, I’ve been widely recognized in the financial press as one of the leading authorities on the subject - so much so that even the prestigious New England Journal of Medicine cited my work and how it could be applied to medicine.

Our mission remains unchanged from the day of our founding - help investors turn the tables by putting the odds in their favor. From education that starts at the beginning, to leading edge software that gives traders a proven advantage, we are your one source for the best in options analysis.

Best of all, we take everything we’ve learned over the past several decades and make things simple. Because our goal has always been to Make Options Easy.

So whether you’re a brand new beginner, or a seasoned veteran...

Trade the ODDS. Make the Money.

What The Top Options Professionals

Think Of ODDS

What The Top Options Professionals

Think Of ODDS

What The Top Options Professionals

Think Of ODDS

"I was blown away by how flexible and easy ODDS Online is."

"I was blown away by how flexible and easy ODDS is. It had amazing technology that makes it lightning fast to find great option trading strategies. Once I saw the power of ODDS, I knew I had to get this to my candlecharts.com family ASAP."

Learn more about what ODDS Online can do for you, for only $29 per month (after the initial set-up fee) HERE.

"An important tool for the serious trader."

"An excellent treatise on how to calculate the probability of a market move occurring – an important tool for the serious trader. Don’s presentation is thorough, analytical, and delivered at a pace that makes it easy to understand."

"An important tool for the serious trader."

"An excellent treatise on how to calculate the probability of a market move occurring – an important tool for the serious trader. Don’s presentation is thorough, analytical, and delivered at a pace that makes it easy to understand."

"We are glad that ODDS selected Hanweck data."

"We are glad that ODDS selected Hanweck data to generate their investment research and are proud that we were able to provide the speed, ease of use, and accuracy required to conduct this level of in-depth, innovative analysis."

"We are glad that ODDS selected Hanweck data."

"We are glad that ODDS selected Hanweck data to generate their investment research and are proud that we were able to provide the speed, ease of use, and accuracy required to conduct this level of in-depth, innovative analysis."

Our Products

Our Products

Our Products

Options Trading As A Business

The first step in any business starts with an idea. In options trading, you do the same thing. We will teach you to find situations that the market has not discovered yet...

Options Trading As A Business

The first step in any business starts with an idea. In options trading, you do the same thing. We will teach you to find situations that the market has not discovered yet...