ODDS Profit Alerts

Frequently Asked Questions, Answers, and Instructions

- What exactly is ODDS Profit Alert?

- Upon what trading methodology is ODDS Profit Alert based?

- Are you in the market all the time, or are there lengthy dead periods?

- How do you find the trade ideas you publish?

- How do I access the trade ideas you provide?

- So that subscribers can be prepared, may we see what a trade idea looks like?

- Is a put credit spread the only type of high probability trade idea you find?

- What if I don't get filled on the trade on the Friday it is given?

- If I get filled on the spread, what do I do next?

- What is the typical duration of a trade?

- How many option ETF trades could typically be open at any one time?

- Why do you use only broad-based optionable ETFs for the trade ideas on Fridays, and not some other index?

- Does the "How to Spot 90% Winners Instantly" special free bonus report come with the DVD shipment, or will this report be available online at some point?

- What is the ODDS Profit Alert refund policy?

- Can I implement the ODDS Profit Alert trades with an online brokerage?

- Are there any qualifications required?

- How much money do I need to use ODDS Profit Alert?

- Do you provide samples?

- Is there any way to begin the learning process before the DVDs arrive?

- Am I required to take every ODDS Profit Alert trade idea and provide trading statements to get a refund?

- What do I do if there is overlap in the strike price of an old trade with the strike price in a new trade?

- As the options trade ideas are posted every Friday, what expiration do we use? Weeklys or monthly?

Q. What exactly is ODDS Profit Alert?

A. It is a trade idea service consisting of one trade each week with a monthly expiration date. Each week, we post high probability trade ideas for you to consider. The trade ideas are posted to a private, secure web site every Friday morning between 8:30 a.m. and 9:00 a.m. ET. [We post the information on Friday's to take advantage of the "weekend effect" in options.] Because these are trade ideas, and not actual recommendations, we do not provide follow-up instructions. If you want full-service recommendations, with specific price limits, and exact follow-up instructions for all trades that are open, we do offer those features in our ODDS High Accuracy Service

Q. Upon what trading methodology is ODDS Profit Alert based?

A. The methodology is based almost entirely on the high probability index option trading system I've been teaching for nearly two decades.

The details of this particular method were taught from start to finish in my Options Wizardry From A to Z course, which was first offered to the public in 1998. Over the years I added several minor enhancements to make the trading process easier.

Therefore my basic high probability method has a multi-decade history of success.

Importantly, this means we are rarely out of the market. Our objective is to find a high probability spread whenever our key indicator is in normal mode, and if not, we may sit on the sidelines for a week until it returns to normal.

Q. Are you in the market all the time, or are there lengthy dead periods?

A. As stated previously, except in rare circumstances, we expect to provide you with trade ideas each and every week. This means that, as one position expires, we will likely be providing you with a new trade idea.

As noted above, we don't anticipate that there would be lengthy periods where we're idle. In 5 years of testing, there was never an idle period. If, however, the potential profits from doing these types of option trades is so low that the profits wouldn't even pay your commissions, we will elect to stand aside. That did not happen during the time frame between March 2007 and now.

Q. How do you find the trade ideas you publish?

A. It's actually a relatively simple process, once you know what to do. Basically, we use the exact high probability method I've taught those of you that have my Options Wizardry or Profit Power Seminar courses. Although the calculations are easy, they can be tedious. And for newcomers, they can seem overwhelming.

Every Friday morning (if there are holidays, such as Christmas and Thanksgiving, that schedule may change) I'll provide you with a trade idea for you to consider.

Q. How do I access the trade ideas you provide?

A. The first thing you need to do is login. Once you've done that, you'll see a menu of products to which you subscribe. Select 'Go To ODDS Profit Alert'. You'll be sent to the main landing page. Below is an image of that web page.

From there, you can find everything you need.

In the top left corner is the link to the service itself. Below that is a link to the Volatility Escalation Index Chart. That chart is updated daily. At the bottom on the left is a link to the Instructions for using the service along with the most frequently asked questions and answers, and we highly suggest you START WITH THE INSTRUCTIONS.

For your convenience, on the right side of the landing page you'll find links to the Options Wizardry videos and the Trading Manuals. This is in addition to the printed manual and DVDs that are shipped to your home. This is a terrific way to watch videos whenever or wherever you want, without having to bring the DVDs with you.

Q. So that subscribers can be prepared, may we see what a trade idea looks like?

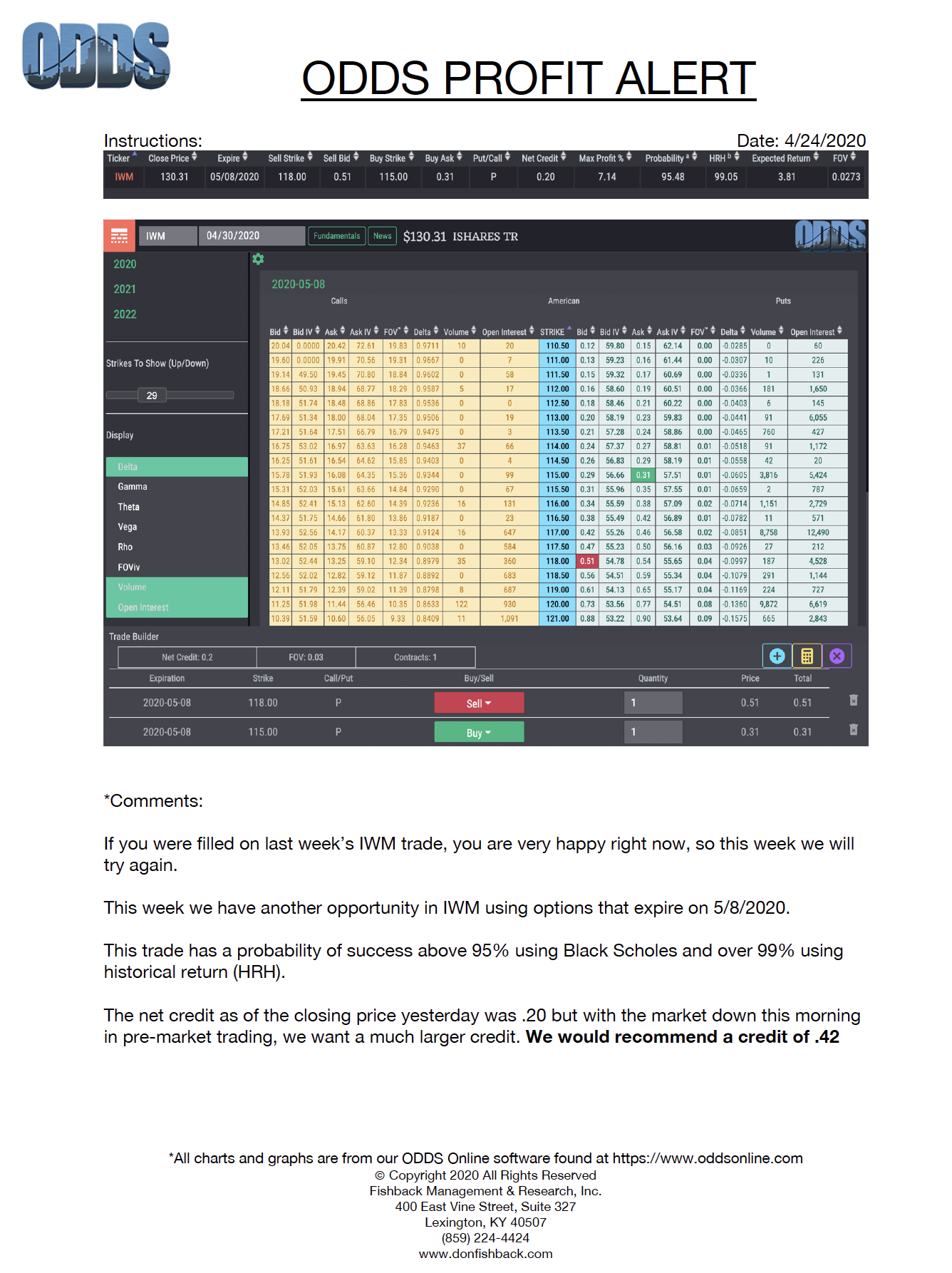

A. Here's an example of the first page of the weekly report. The section containing the actual trade idea is at the top of the page labeled Instructions.

As you can see, we provide the date and the underlying asset. In this example, the asset is the IShares® Russell 2000® ETF (ticker: IWM). Below that is the option trade itself in an image taken from our ODDS Online Software. This example is a put credit spread, otherwise known as Bull Put Spread. There are 2 components to the spread. We are selling a put and buying a further out-of-the-money put.

The prices shown for the options are based on the bid/ask prices that we believe a trader would expect to see, assuming the market conditions in the morning have not deviated substantially from those seen near the close the prior evening.

Be sure to read all the commentary under the trade idea, but you will need to calculate the 'net credit limit' yourself with the closing bid/ask prices given if it is not suggested below the trade in the commentary.

For instructions on how to implement a trade of this type, please read further. We discuss this in the answer to the following question: "Can I implement the ODDS Profit Alert trades with an online brokerage?"

Q. Is a put credit spread the only type of high probability trade idea you find?

A. No. When it is appropriate, we may trade using credit spreads or 4-way spread also known as an Iron Condor. A 4-way spread is where we enter a put credit spread and a call credit spread at the same time. That is we sell an out of the money Put and an out of the money Call, then we buy a further out of the money put and call to limit our risk. This type of trade offers a larger credit than a standard put credit spread.

Q. What if I don't get filled on the trade on the Friday it is given?

A. You can continue to try to be filled using exact parameters given on Friday, but no instructions will be posted for how long to continue or when to stop, as this is a trade idea service only.

Q. If I get filled on the spread, what do I do next?

A. Good question. It is important to realize that ODDS Profit Alert does not provide full-service recommendations. We provide trade ideas for you to consider taking. Because this is a trade idea service, what you do next is up to you. However, I can tell you this, our normal strategy is to hold the position till expiration unless there is something occurring in the markets that may mean we exit on the short side before expiration.

Q. What is the typical duration of a trade?

A. We look for option trades whose expiration date is anywhere from two trading days to seven weeks. That does not mean we remain in the trade that long. Sometimes we close out a position prior to expiration if the profits are too juicy to pass up.

Q. How many option ETF trades could typically be open at any one time?

A. On average, the number of simultaneously open option spread positions peaks at 6.

Q. Why do you use only broad-based optionable ETFs for the trade ideas on Fridays, and not some other index?

A. Optionable ETFs, such as SPY, QQQ, & IWM are very liquid and the bid/ask spreads are very tight. They are also more stable than others.

Q. Does the "How to Spot 90% Winners Instantly" special free bonus report come with the DVD shipment, or will this report be available online at some point?

A. The bonus report will be in your dvd package mailed to your home. If you do not receive it in your package, call 888-233-1431 and they will send another one to you.

Q. What is the ODDS Profit Alert refund policy?

A. Cancel at anytime after the first 90 days for a pro-rata refund, or return all items before the first 90 days of your subscription for a full refund. We also guarantee that we will refund double your initial payment if you get anything less than a 90% success over the course of a year.

Q. Can I implement the ODDS Profit Alert trades with an online brokerage?

A. Yes. Most online brokerage interfaces now give you the capability to enter all the necessary information to implement the trades correctly. Just make sure your online brokerage provides you the ability to enter your order with the correct data (i.e.: credit spread or iron condor, which market and symbols, how many positions you want), emphasize the "net credit" amount (never accept less than the minimum credit), and place as a "limit" order.

Q. Are there any qualifications required?

A. There are no qualifications required to subscribe. If you want to subscribe in order to learn, that's fine with us. But if you want to trade the recommendations, the trading level required for the service is Level 4. That's the level required to trade the credit spreads, which nearly all of our customers qualify for. Trading the ETF portion of the service requires the same suitability as investing in an ETF.

Q. How much money do I need to use ODDS Profit Alert?

A. We don't have a minimum account size recommendation. As stated above, there is no requirement for you to trade the recommendations. You can subscribe to this service just to learn. If, however, you do trade, you'll need to open an account.

As noted previously, there is no minimum account size to subscribe. But if you trade with a tiny account, you may not be able to implement all the trade ideas we provide.

The good news is that, let's say you take one trade per month and ignore the rest. Testing has found that the trades that take place early in the expiration cycle actually perform a bit better than the trades that come closer to expiration.

If you only trade the early recommendations, you should do well. If you take all the recommendations, you should do better, because you have more profit opportunities.

Q. Do you provide samples?

A. Yes. A complete sample can be found here ODDS_Profit_Alert_ExampleQ. Is there any way to begin the learning process before the DVDs arrive?

A. Yes. As a convenience to you, we provide online access to the videos and manual. You can access them by logging in and selecting them on the main ODDS Profit Alert web page.

Q. Am I required to take every ODDS Profit Alert trade idea and provide trading statements to get a refund at the end of one year?

A. The recipients of the guarantee based on one year are intended to be only those who actually made the trades and lost over that year. If you don't want to take the trades, that's fine. But you must provide proof that 90% of the trades over the prior year did not win. That can be done by providing paper-trading or virtual-trading records. Also, please note, the refund policy is after your full year of your subscription only.

Q. What do I do if there is overlap in the strike price of an old trade with the strike price in a new trade?

A. Because we have multiple trades that expire at one expiration, this does happen, but not very often and you don't need to worry. You don't need to take the new trade in a different account. If there is overlap in the strike prices, you will be closing one leg of an existing position and adding a new leg to the position. For example: If I had a trade where I sold the 250 Put and bought the 247 Put for a credit of 0.25. My reward would be $25 per contract and my risk would be $275 for a 9% profit. Now I get a new trade that asks me to sell the 253 Put and buy the 250 Put at the same expiration for a credit of $25. Instead of having 2 positions in my account I will have only one, but my risk and reward will be identical to my potential of doing both trades in a different account.

Some brokers have you place the order specifying buy to open and sell to open or buy to close and sell to close. If your broker does this you may need to be careful how you enter the order. In this situation, I would place the order to buy to close the 250 put that I sold and sell the 253 put to open for a net credit of 0.25. My previous trade was a 3-point wide credit spread. After this order is filled, I would have one 6-point wide credit spread instead of two 3-point wide credit spreads.

I would have collected $50 of credit per contract total and my risk would be $550, exactly as if I had done the trades separately in different accounts.

Q. As the options trade ideas are posted every Friday, what expiration do we use? Weeklys or monthly?

A. The expiration we select will ALWAYS be based on current market conditions. The goal is to sell the most expensive options. Sometimes the most expensive options are weeklys and sometimes they are monthlys. We will select the most appropriate expiration based on the balance between risk, reward and probability in the trade.

There you have the answers to the questions I am most often asked. I hope that these help you get started using ODDS Profit Alert.