Frequently Asked Questions, Answers, and Instructions

- How do I get the trade ideas each day?

- What types of strategies are provided by FLASHPOINT?

- How do you identify your trades? Do you buy options on stocks that you’re interested in?

- How much money do I need to make FLASHPOINT trades?

- What does a new recommendation look like?

- What criteria is used to determine which stocks appear in the list each day, and also the color of the arrows?

- What exactly does the Liquidity Column tell me?

- What determines when the market volatility is a down red arrow? Does that mean volatility is too high or too low?

- If testing has shown that taking any trades with a red down arrow is bad, why do you include them in the list?

- There is a trade that is listed with all green up arrows, but I am already in the same trade from when it was all green up arrows a few days ago. What should I do?

- What if there are a lot of trades ideas listed with all green arrows. How do we know how to choose from them?

- What price should I use to enter a trade that I decide to enter?

- Can I implement portions of the recommendations separately with these trades? For instance, can I buy the call part of the straddle recommendation separately from the put part?

- How long should I continue trying to be filled on a trade?

- If I get filled on the recommendation, what do I do next?

- Do you ever use stops?

- Why would I place a straddle trade when it has such a low probability of winning?

- What is the typical duration of a trade?

- What money management rules do you follow to set up your own options portfolio?

- How many trades are typically open at any one time?

- Can I implement the FLASHPOINT recommendations with an online brokerage?

- What should I look for in a broker?

- Where can I get more background information on options to help me understand the basics?

- If I have login problems, who do I contact?

- What if I still have questions regarding the FLASHPOINT service?

- A stock on the list is showing a green arrow in the liquidity column, however I show no open interest in either the calls or puts. Is there a reason for this?

Q. How do I get the trade ideas each day?

A. With FLASHPOINT, to get your daily trade ideas you simply log in every trading morning by no later than 8:30 a.m. ET to our secure web site which is: www.donfishback.com , except on the first Friday of each month when there is a employment report, the update will be at no later than 8:45 a.m. ET. There you enter your Userid (which is your complete email address), and your password, which were both included in your confirmation email. Login is ‘case’ sensitive, so you must use capital letters where shown. NO emails are sent, as this service is accessed all online.

Q. What types of strategies are provided by FLASHPOINT?

A. With FLASHPOINT, I generally recommend one type of trade: high profit trades with explosive potential. With high profit trades, I use the simplest strategy available: straddle purchases. The reason is because these types of trades let us profit from volatility without having to predict which direction the stock will take. With a straddle, we’re buying a call and a put that have the same strike price and the same expiration month. On a rare occasion, I may recommend a different type of high profit trade, but for the most part, your high profit trades will fall into the straddle category.

With a straddle trade, you normally make money on one option, and lose money on the other. The goal is to make more than you lose. For instance, let’s say you buy a call for 1 and a put for 1. Your total cost—your net debit—is 2. The way you make money is where the stock makes a big move.

Let’s say the stock falls pretty hard. The call falls in price, dropping to zero. But the put goes to 4! In this instance, even though you’ve lost on the call side, the gain in the put more than makes up for the loss. In fact, the total return is a 100% gain: invest 2 to make 4.

If the stock rises, the call gains value while the put loses. If the stock rises enough, gains in the call more than offset any losses in the put, generating a profit for the entire position.

Q. How do you identify your trades? Do you buy options on stocks that you’re interested in?

A. Picking options and picking stocks are totally different functions. With stocks, you are pretty much guessing which direction the stock price will go, which means that you usually need to analyze the company’s business fundamentals to make that prediction. With options, that’s not the case. In fact, you don’t even need to know the business of the company you’re trading. My primary focus in selecting options trades for you is an asset’s current volatility relative to its historical volatility. So what does that mean? Let me share an analogy to explain why this is such a powerful way to trade.

Let’s assume it is October in Chicago. You know it’s not going to be 110 degrees. You also know it’s not going to be –30 degrees. The temperature should be about 45 to 60 degrees. You can make that forecast because that is what the temperature in Chicago during October has been historically. This type of temperature analysis is identical to the analysis of historical volatility. (Historical volatility is simply the volatility that the underlying asset has experienced in the past.) Like temperature, volatility has what is called a central tendency. When temperatures get unseasonably cold, they tend to rise back to the seasonal norm. When temperatures get unseasonably warm, they tend to drop. Volatility behaves in a similar fashion. When it gets too low it rises, and when it gets too high it drops.

The point of this illustration is this: When volatility is hitting unprecedented, low levels, you have to ask yourself, “Is the calm weather last forever?” You know that it doesn’t, and neither does the opposite extreme. When volatility is extremely high, it tends to drop. When it is extremely low, it tends to rise. By putting this concept to work for us, we’re able to make money on an investment’s fluctuations without worrying about direction.

Q. How much money do I need to make FLASHPOINT trades?

A. While there really is no set minimum that you need in order to trade (other than the minimum your broker charges to open an account), it is best to have enough money to be able to place several trades. You don’t want to have everything tied up in one or two positions. In general, the high-profit positions I’ve been recommending in FLASHPOINT have ranged from a maximum of $400 and to less than $400. (*Note: The maximum price of $400 is a new filter we just added as of 9-1-15, because we found that options priced higher do not make a difference in how the trade works out.) At that price point, a $10,000 account will allow you to place several trades while still keeping enough liquidity for new opportunities that come along.

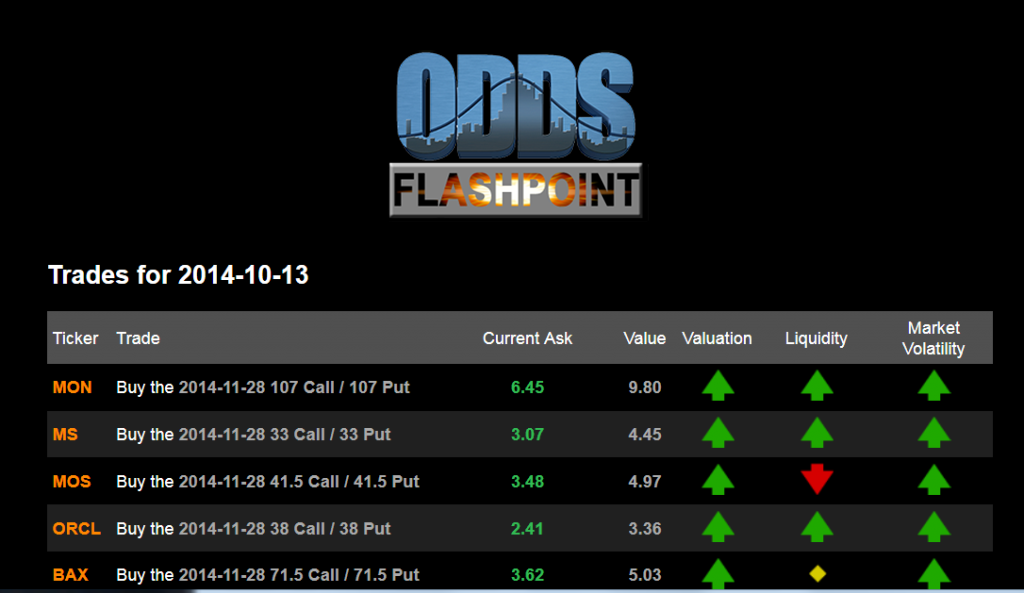

Q. What does a new recommendation look like?

A. We want you to be prepared, so we’re providing you with an image from a recent report.

This report could not be easier to use. That’s because we’ve color-coded everything to make it as simple as possible. Read on, and you’ll see why.

At the very top of the report, we show the date: 2014-10-13. Please note that we display the date in database format. There is nothing difficult about database format. First, we show the year, then the month, then the day. In this particular instance, the year is 2014, the month is 10, and the day is 13. So the date is October 13, 2014.

The trades are sorted in order of straddle cost versus straddle value. Straddles where the price is lowest compared to the value are at the top of the list. Straddles where the price is highest compared to the value are at the bottom of the list.

Our research has found that if a straddle is too cheap, you don’t want to do the trade. It’s as if the market knows something you don’t. So extremely cheap straddles have a red down arrow in the Valuation column. At the other end of the spectrum, you don’t want to buy straddles that are extremely expensive. So expensive straddles have a red down arrow in the Valuation column.

There are also what we call “edge cases”: straddles that are on the borderline between too cheap or too expensive. Those trades have a yellow diamond in the valuation column.

Then there are those that are like “Goldilocks” — not too cheap, not too expensive. Those straddles have a green up arrow in the Valuation column. These are the straddles with the most optimal price/valuation comparison.

Before we discuss that color scheme, let’s look at an individual trade. We’ll start at the top of the list with a trade on MON.

Next, we have the actual trade idea itself:

Buy the 2014-11-28 107 Call/ 107 Put. We use exact dates to describe the option because of the proliferation of weekly and quarterly options. We do not want there to be any confusion as to what option in November you should be trading. But for most people, this would be referred to as the November 107 straddle.

Next we have the pricing and valuation: The current “ask” price of this straddle is 6.45. Note that we do not have the prices of the individual options. As I said before, what matters is that you buy both options, and that you do so for one price. Unless you are a very sophisticated trader, do not implement a straddle by entering the components separately. Also note that we show the ask price because that is what a trader could expect to actually pay for the options as the maximun net debit.

To the right of the ask price, we have the valuation. This is a calculation that is based on decades of proprietary research I developed. Data-mining research has shown that the lower the ask price is below the value, the better.

Now we get to the good part. This is why you are a FLASHPOINT member. The colored up and down arrows & diamonds!

The arrows & diamonds are super-simple, easy-to-understand, color-coded graphical displays of the various factor ratings that determine whether or not we should take a trade. They work just like traffic signals with the colors, and for those of you that cannot see the true colors, we added up arrows for green, diamonds for yellow, and down arrows for red.

Our research has shown that three factors are key to success in trading options: Valuation, Liquidity and Market Volatility. So we’ve made it easy for you to determine what those factors are. Just like a traffic signal, Red (down arrow) means stop, Yellow (diamond) means caution, Green (up arrow) means go.

If you see a red down arrow, STOP. Do not take any trade with a red down arrow. If you see any yellow diamonds, proceed with caution. If you see all green up arrows, it is okay to take the trade. It is even okay to take trades that have two green up arrows and one yellow diamond.

Testing has shown that taking any trades with a red down arrow or two yellow diamonds could adversely impact your results!

Q. What criteria is used to determine which stocks appear in the list each day, and also the color of the arrows?

A. The first criteria is the stocks must be compressed. We then take that list and apply certain real world filters, such as:

- Value –

-If the ask price is above the value, meaning the options are overpriced, the arrow will be a red down arrow.

-Another reason for a red down arrow is if the ask price is far below the value price, which means there is a fundamental reason for that to occur.

-If the ask price is modestly above the value, the color will be a yellow diamond.

-If the ask price is below or no more than 2% above the value, it’s a green up arrow. - Liquidity– (this criteria lets you know how easy it is to turn your trade into cash.)

-If the difference in the bid/ask price and stock volume is poor, the arrow will be a red down arrow.

-If the difference in the bid/ask price and stock volume is better, it will be a yellow diamond.

-If the difference in the bid/ask price is narrow and the stock volume is good, the color is green up arrow.. - Market Volatility–

-If market volatility is so low that it’s unlikely to see a major move, the color is red.

-On the other end, if market volatility is so high that option prices are inflated, the color will be red.

-If market volatility is low to moderate, the color will be yellow.

-If the market volatility is in range where straddles can be profitable, the arrow will be a green up arrow.

Q. What exactly does the Liquidity Column tell me?

A. This column shows us how easy it will be to exit the trade now, and gives a good expectation for how hard it will be later.

We are particularly looking at the bid/ask spread. If you buy an option for 5 dollars(the ask), but only can get 3 dollars now for selling it(the bid), the bid/ask spread is too great(by a lot!). A bid of 4 dollars would be closer, and you would probably get a yellow diamond, but 4.50 would get you a green arrow up. Think of it this way, the liquidity indicator lets you know how easy it is to turn your trade into cash.

Q. What determines when the market volatility is a down red arrow? Does that mean volatility is too high or too low?

A. To determine the Market Volatility we use the VXO, and we have a threshold that we are going to keep to ourselves, but realize if it gets exceptionally low, ODDS Flashpoint will start picking up trades.

On the other hand, if VXO gets in this middle area of no-mans-land (somewhere between 10-15), then it there will be a red down arrow. Our research has shown that straddles should be avoided during this time.

Q. If testing has shown that taking any trades with a red down arrow is bad, why do you include them in the list?

A. First, every stock that appears on the FLASHPOINT list is compressed. Then we put those compressed stocks through the 3 proprietary filters. This is when you will see the results of whether or not those filters are met by the colored arrows or diamonds. Another reason is that many seasoned options traders may look at the list and see a red down arrow, but their other analysis creates a situation where they may use that and either do the trade or a version of it.

Q. There is a trade that is listed with all green up arrows, but I am already in the same trade from when it was all green up arrows a few days ago. What should I do?

A. Because new subscribers are constantly coming on to the service, we do not filter out repeat trades. We don’t want to short-change those who have just joined. But for those of you who have already entered a trade, and the trade idea shows up again, we would not be inclined to add to an already established position. Ultimately, it’s up to you. But we do not believe that concentrating your money in any one trade is a good idea.

Q. What if there are a lot of trades ideas listed with all green arrows. How do we know how to choose from them?

A. When the list is long, here is what I do:

I start at the top, because they are ranked in order of mathematical expectation. Next, I go down to the first one from the top that has green arrows (skip any red ones.) I only select a few each day. I don’t want to pile in all at once. So I may choose only 3 or 4 on any given day.

I like to focus on the cheapest priced straddles. Our research has shown that straddles priced below $400 tend to perform similar to straddles priced over $400, which is why we changed our filters to only allow straddles with a maximum price of $400. Because we have subscribers with all sorts of different sized accounts, I like to focus on the low cost straddles for those folks with smaller accounts.

I also like to diversify across sectors. That’s a good idea, even if it does mean going deeper down the list.

Q. What price should I use to enter a trade that I decide to enter?

A. Because these are straddles, which means that the options tend to drop in value slightly as time goes by, there is no need to ever pay more than the price shown (ask). As discussed in the next section, you can easily place these trades as a unit. By purchasing a straddle at a price higher than that which is shown, you increase your risk, reduce your probability of profit and reduce the size of your potential gain. In every way, you are adversely impacted. There will be times when we don’t get filled on a trade, but it’s still not worth entering at a price worse than what I recommend. If you overpay for options and get out at the same price as other customers, you could suffer a loss while they might profit. Don’t let that happen.

Q. Can I implement portions of the recommendations separately with these trades? For instance, can I buy the call part of the straddle recommendation separately from the put part?

A. Because this is a trade idea service, as opposed to us actually managing your money, you are free to do what you want. But I sure wouldn’t buy the options separately. By placing separate orders, you risk two things: First, you risk getting filled at a worse price, which will adversely change your probability of profit and worsen your risk and reward potential. Second, you risk getting filled on one portion and not the other, which gives you a different position altogether and puts you in a position where you can only profit if the trade moves in one direction.

Q. How long should I continue trying to be filled on a trade?

A. The trade ideas are good for one day only. Do not try to enter the position after the U.S. market closes. The daily trade idea list is provided at 8:30 a.m. Eastern Time before the market opens so that you can act on them immediately. Because options move so quickly, it’s important to take action right away so that you have the best chances of getting filled. On the other hand, there are times when you can’t get filled right away, which is why you should try to fill the order by the end of the day. I do not suggest continuing beyond the day’s close, as market conditions may have changed too much after that time. If you do not get filled on the recommendation, make sure the order is canceled by the end of the day and wait for my next recommendation. If you use a “day order”, the end-of-day cancellation happens automatically.

Q. If I get filled on the recommendation, what do I do next?

A. FLASHPOINT is a deeply discounted trade idea service. We do not provide allocation advice, contract quantities or exit instructions. Because we aren’t performing those tasks that require substantial effort, we pass those savings on to you. If you need assistance on how potential exit strategies, we highly recommend our Profit Power Seminar (available via Home Study Course, or, from time to time, via Live Seminars around the country).

Q. Do you ever use stops?

A. Although we don’t provide exit advice on each specific trade, I strongly believe that with high-profit straddle trades, it’s best to not let the position waste away to nothing. I tell people that it’s important to treat trading like a business—you need to have an action plan and a contingency plan. My motto is that I hate to lose. We can’t avoid losing, but we can mitigate the risk. For that reason, I’ve got a pretty strict contingency plan for how to get out of losing positions.

Our stop strategy is pretty simple. If the position ever closes at a 50% loss, we exit. For instance, if I buy a call for 2.50 and a put for 2.60, the combined straddle price is 5.10. If the bid on the straddle is less than 2.55 at the close on any day, I exit the next morning.

Q. Why would I place a straddle trade when it has such a low probability of winning?

A. As the name of the strategy implies, high profit trades are all about making a lot of money on a single trade. The potential opportunity is pretty consistent, if you exit right. But if you don’t, the probabilities diminish. Nevertheless, even if you did nothing but follow our stop loss advice and held all the other trades till the last trading day and sold just before expiration, the trades still make a nice profit.

That’s because the combinations that I recommend have very high, unlimited profit potential. However, as with any investment, the greater the potential reward, the lower the probability. With these trades, we are not going to win every single time; we will have some losing trades, which is why it’s important to spread your investments across several positions. But the benefit is that when we win, the rewards are so high that they more than offset the losses. In fact, my track record shows that, even using this very rudimentary exit strategy, the size of the average winner has been much greater than the size of the average loser. That risk/reward edge turns out to be the difference maker. It’s what causes our overall track record to be so profitable, even though the probability of profit is not as high as it could be if a more optimal exit strategy was employed.

Q. What is the typical duration of a trade?

A. We look for option trades whose expiration date is anywhere from 45 days to 70 days in the future. That does not mean we remain in the trade that long. Sometimes we close out a position prior to expiration.

Q. What money management rules do you follow to set up your own options portfolio?

A. The only tried and true rule that I follow when setting up my portfolio is to stay diversified. I don’t recommend a model portfolio, or choose options based on different sectors. However, I do advise that you never invest more than 5% of your trading portfolio in one position. You don’t want to overcommit in one position and miss out on other opportunities that come out afterwards. If you like to stay active and want to have the opportunity to invest in all of our new trades, you’ll want to keep each invested amount even smaller than 5%.

Q. How many trades are typically open at any one time?

A. On average, the number of simultaneously open trades peaks around 10. There are, however, rare instances where that number climbs higher. From mid-March 2011 to mid-May 2011, we had as many as 50 open positions. It would be very difficult for the typical retail investor to take every trade.

Q. Can I implement the FLASHPOINT recommendations with an online brokerage?

A. Yes, most online brokerage interfaces now give you the capability to enter all the necessary information to implement the trades correctly. Just make sure your online brokerage provides you the ability to enter your order with the correct data (i.e.: straddle/strangle/credit spread, which market and symbol, how many positions you want), emphasize the “net debit” amount (never pay more than the net debit or accept less than the minimum credit), and place as a “limit” order.

Q. What should I look for in a broker?

A. Whatever you do, don’t put commissions at the top of the list of things to consider. While commissions are a factor, they should be at the bottom of the list. Here are the things that I consider to be most important when choosing a broker for your options account:

- Account size requirement. The minimum account size should be between $5,000 and $10,000 to trade option combinations and spreads. Some brokers have large minimums for option spreads and combinations. That’s because they don’t understand how options really work.

- Back-up systems. If the routine order placement system (like the Internet) goes out, how will you place your order? You don’t want to get locked out of the market, or stuck in it. Make sure your broker has a back-up system in place.

- Experience. You should look for someone who has experience. You don’t want to be on the phone having to teach your broker about options. You want someone who understands options and option combinations (like a straddle). This is true even for online brokers, because if the online system goes out, you’ll be on the phone with a live broker as part of the back-up system.

- Limit orders on option combinations. Most online system allow limit orders on option combinations. Your broker should be able to buy and sell option combinations, and place a price limit on the entire combination.

Q. Where can I get more background information on options to help me understand the basics?

A. FLASHPOINT is geared toward options traders who have a basic understanding of options. However, this service can certainly be used by novice options traders to gain a better understanding of options. If you need to enhance your knowledge of options, I suggest you check out my comprehensive educational course Options Wizardry from A to Z book, as it is a great reference for getting started or reviewing the basics. If you do not have a copy of this course, please call my support team at 859-224-4424 for more information.

Q. If I have login problems, who do I contact?

A. If you cannot access the FLASHPOINT web site, please contact customer service at support@donfishback.com, or by phone 888-233-1431. They will check to see that we have the correct login information for you, or if there is another issue causing the problem. Likewise, if you change your personal information, please contact us so that we can update your account and avoid causing a problem in service.

Q. What if I still have questions regarding the FLASHPOINT service?

A. One of the benefits of the FLASHPOINT service is that I have a highly trained staff to help you with any questions you have about how to act on my advice and recommendations. They don’t just answer the phones to take address corrections. They also trade. I encourage you to take advantage of this service by calling the Technical Support Hotline at 859-224-4424, or by sending an email to support@donfishback.com. The support staff will help you with any additional questions that you may have.

Q. A stock on the list is showing a green arrow in the liquidity column, however I show no open interest in either the calls or puts. Is there a reason for this?

A. The liquidity in ODDS Flashpoint is based on the bid/ask spread of the options, and the volume of the stock. The key is whether the market makers have the ability to offset the positions. If the bid/ask spread is narrow, and the stock volume is good, it’s an indication that the market makers are willing to make a tight market.

There you have the answers to the questions I am most often asked. I hope that these help you get started using FLASHPOINT and answer any questions you had. I look forward to working with you in the coming months, and wish you the best of luck in your options success!